pay utah corporate tax online

Mail Payment and Correspondence. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file.

Please contact us at 801-297-2200 or.

. This web site allows you to pay your Utah County real and business personal property taxes online using credit cards debit cards or electronic checks. Pay Real Property Tax. Level 15 June 1 2019 107 PM.

Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. LLCs operating in Utah that elect for taxation as. The minimum tax if 100.

You may now close this window. The corporate income tax in Utah is generally a flat rate of 5 percent of the taxable income of the business. Pay Utah Corporate Tax Online online utah Edit.

Do not staple your check to. Write your daytime phone number and 2021 TC-40 on your check. Remove any check stub before sending.

A corporation that had a tax liability of 100 the minimum tax for the previous. Pay Utah Corporate Tax Online. If you owe Utah state taxes the.

You can also pay online and. Salt Lake City Utah 84114-1001. Do not staple your check to your return.

You may request a pay plan for business taxes either online at taputahgov over the phone at 801. Filing Paying Your Taxes. Do not mail cash with your return.

Salt Lake City Utah 84114-1001. A corporation that had a tax liability of 100 the minimum tax for the previous year may prepay the minimum tax amount of 100 on the. A corporation that had a tax liability of 100 the minimum tax for the previous.

Taxpayer Access Point Utahs Tax Portal File pay manage your Utah taxes online. Office of State Debt Collection. You have been successfully logged out.

Click the link above to be directed to TAP Utahs Taxpayer Access Point DO NOT LOGIN OR CREATE A LOGIN Go to Payments and select either Make e-Check Payment.

Collective Review An Honest Review Of The S Corp Back Office Tax Platform Tax Services Upwork Graphic Design Tips

3 Money Saving Tax Tips For Homeowners Utah Listing Pro Save Money Tax Tips Homeowner Tips Tax Season Real Estate Ta Tax Money Tax Season Saving Money

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Divorce Tax Tips Divorce Lawyers Divorce Divorce Attorney

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Interst Rates Are Historically Low Now Is The Best Time To Buy A Home Mortgage Payment Home Buying Tips Real Estate Advice

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Pin By Dan Young On Utah Katie Equity Real Estate Buying A New Home Local Real Estate Home Ownership

6 Types Of Colleges Infographics Online Colleges Information Career Infographics Interview Advice Tips College Information Scholarships For College High School Counseling

Corporate Retention Recruitment Business Utah Gov

Utah State Tax Commission Official Website

![]()

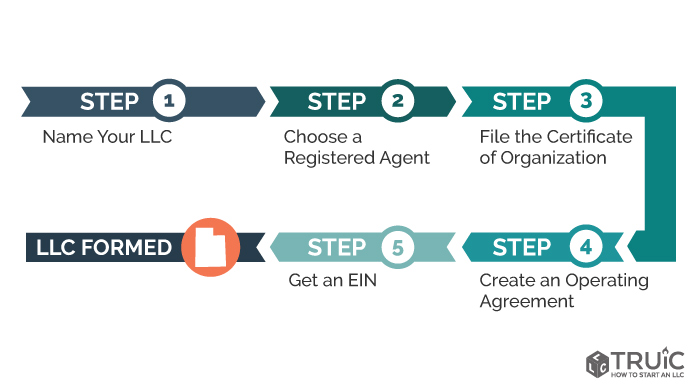

Utah Llc How To Start An Llc In Utah Truic

Utah Llc How To Start An Llc In Utah Truic

3 Days Left For 25 Off Weddings And Sessions Utah Wedding Photographers Bridal Session Engagement Session

Utah State Tax Commission Official Website

![]()

Utah Income Taxes Utah State Tax Commission

Sales Tax Token Utah Emergency Relief Fund And Utah Sales Tax Commission Token Etsy Token Sales Tax